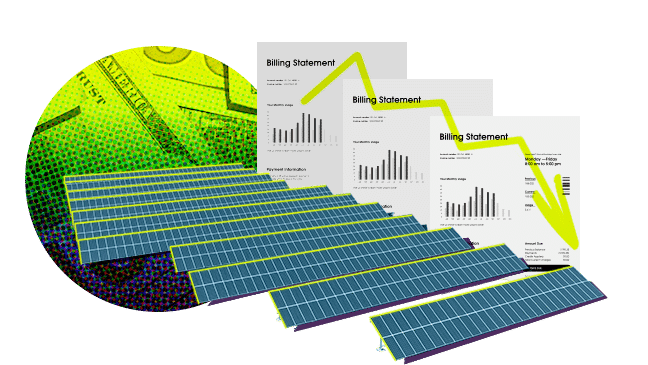

It’s a scenario that happens all too often: Your company has seen an increase in energy costs in recent years. Whether from energy utility rate increases or higher energy demand (or both!), it’s clear that the high energy costs significantly drain your company’s budget.

You know incorporating commercial solar energy into your energy mix can lower those costs by reducing the amount you pay per kilowatt-hour – and that makes a solar + storage system a logical win-win for your company’s budget, operations and sustainability goals.

But convincing leadership of the sustainability and cost-saving benefits of a solar + storage system isn’t your biggest hurdle. You need to know the best way to finance your project.

As companies nationwide adopt solar and energy storage at record levels, they often find themselves torn between two of the most common financing options: cash and power purchase agreements (PPA). And on the surface, it’s not always the easiest to determine which is best for your business.

In this blog, we’ll explore commercial solar PPAs and self-owning your own solar assets to help your business decide which is right for your business and budget.

What Is a Commercial Solar PPA?

Commercial solar PPAs are long-term agreements (typically 20-25 years) between a business and a solar developer. In recent years, it has gained popularity and emerged as the go-to financing option for organizations going solar.

How Does a Commercial Solar PPA Work?

With solar PPAs, a solar developer builds, owns, maintains and operates a solar energy system on your property.

The process is pretty straightforward:

- Your business provides the site (rooftop, parking lot or open land) for a solar installation.

- The solar developer handles the rest, including construction, permitting, installation, long-term maintenance and operations over the life of your PPA.

- Your organization purchases the electricity produced at a predetermined rate measured in kilowatt-hours, just like your current utility bill.

Once the PPA term is up, businesses can typically purchase the system at a reduced price, begin a new PPA or have the developer remove the system.

What Are the Benefits of Solar PPA Financing?

Solar PPAs offer numerous advantages, including:

- Minimal or no upfront spending: A key advantage of solar PPA financing is its zero (or low) upfront costs. This allows companies to move solar projects off their balance sheet, which can help preserve significant capital for more pressing business priorities.

- Immediate savings and long-term protection against rising electric costs: Because a solar PPA locks your business into a long-term electricity purchasing contract, your rate won’t be exposed to fluctuating costs. With most companies feeling the sting of rising electric costs in recent years, the ability to lock in today’s prices provides savings and price predictability for as long as 20 years.

- No maintenance required: When financing your company’s project with a PPA, you can shift O&M risks to your solar developer. That means your company won’t be responsible for operations, maintenance or monitoring. And since the developer owns the system, they’re accountable for rising insurance premiums, protecting against outdated technology, and more.

- Less risks: Under a PPA, the solar developer assumes all liability risks for the system, including shouldering the burden of rising insurance premiums. That means your team can have confidence knowing that it has ample insurance to protect its solar assets.

The Future of Commercial Solar PPAs

The growth of the solar PPA market has grown tremendously in recent years and continues to be widespread across America and abroad. In 2023 alone, corporations announced 46 gigawatts of PPAs, a record high for the calendar year. In the U.S., PPA investments have grown more than 5x in the past 10 years.

There’s no reason to believe these trends will slow down any time soon. If anything, sustainability will become more critical as we move into the future.

Paying for solar with cash

Many companies still choose to pay cash for their projects with plans to self-own and operate their solar assets over the long term, but that can also come with caveats to consider:

- High upfront costs: Paying the full price upfront for your solar project can be a substantial financial investment for some businesses that may not have the liquidity to invest in solar outright. And for companies with the cash to purchase their project outright, it may be wise to consider conserving that capital for other, more pressing projects and priorities.

- Operations and Maintenance: Companies that choose to pay cash for their systems have to shoulder the burden of dealing with permitting, monitoring, maintenance, operations and upkeep. Replacing a single component can quickly escalate into reconfiguring a portion of their PV system, which can get complex without the proper expertise and access to equipment. Without the ability to outsource these repairs to a dedicated and experienced solar asset manager, their maintenance team is faced with optimizing the solar project as issues arise.

- Rising insurance premiums: If your organization chooses to self-operate and maintain its solar and storage systems, high premiums due to inflation and increasing hazard areas (i.e., floods, windstorms, hail or wildfires) may significantly impact your ability to secure affordable property insurance each year.

- Supply chain delays: When attempting to order parts on your own, it’s not uncommon for lead times on equipment to exceed a year, leading to significant downtime when waiting for delivery. Without a solar developer with quick access to equipment, it could be hard to navigate supply chain issues on behalf of your organization.

What Other Solar Energy Financing Options Are Available?

On the surface, a commercial solar PPA and lease may seem similar. There are no upfront costs. The solar developer is responsible for your system’s design, construction, installation and permitting. The developer also handles maintenance, ownership, and operations.

However, a closer look at the two financing options shows the difference is in the details.

Solar Leasing

With solar leasing, you pay a fixed monthly fee for using the solar panels installed on your property, regardless of your energy usage for any given month. That differs from a solar PPA, which is directly tied to your system’s production, giving you more control over the monthly amount you pay.

How Do I Know if a Solar PPA is Right for my Organization?

If you’re still unsure whether a PPA or cash is right for your company, working through the following points can help you decide.

- Are PPAs allowed in your state? As of 2025, 28 states offer PPAs, plus Washington, D.C. (If your state doesn’t allow power-purchasing agreements, solar leasing may be a comparable financing choice.)

- Compare energy prices before and after a potential PPA. Next, look at the current price you pay per kilowatt-hour and compare it to quotes from energy companies. Your post-PPA price can be meaningfully lower. You can add those savings for each kilowatt-hour your company uses over the agreement’s lifespan. This will help you estimate your total savings from a PPA.

- Consider the costs, risks, and benefits of purchasing a solar energy system. Finally, solar ownership should be compared to a PPA. Both options should save your company money in the long run, but ownership carries a high upfront cost and potential ongoing charges. You can run some calculations to see which choice is right for your budget.

Invest in the Future of On-site Commercial Solar Energy with REC Solar

Choosing a PPA partner with a proven track record of helping businesses like yours succeed is essential. REC Solar has over 25 years of experience supporting companies nationwide as they pursue their solar goals. We’re here to do the same for you.

Contact REC Solar today to learn more about how we can help.